BUYING SERVICES

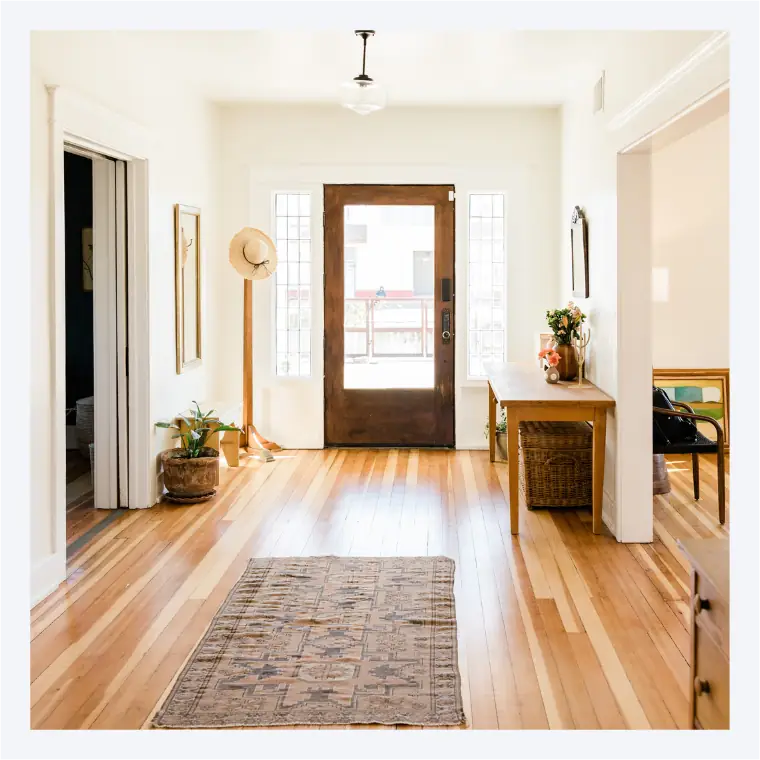

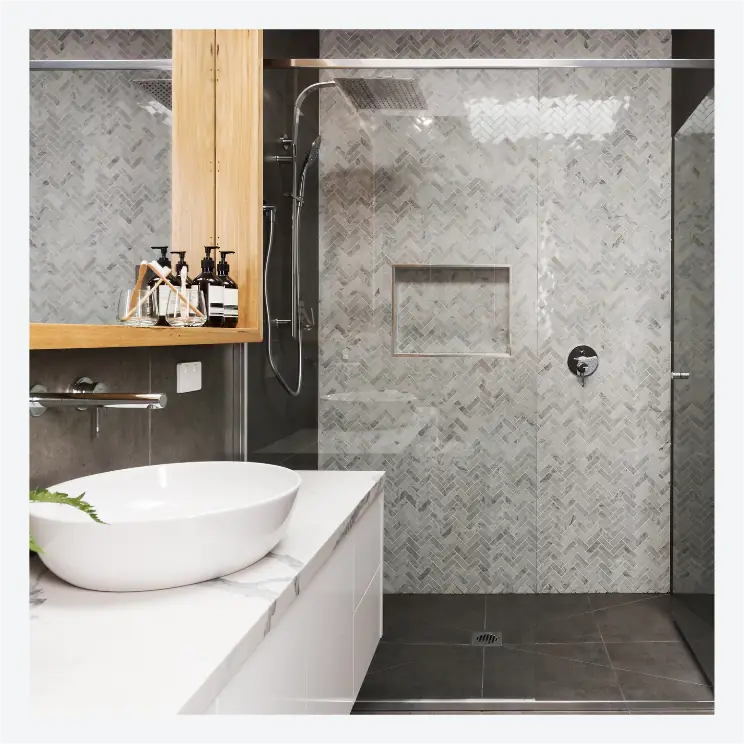

Our innovative buying system offers a unique approach to real estate purchasing.

We have options and relationships available that cater to the needs of both first-time home buyers and seasoned investors.

PRESIDIO PROVIDES SOLUTIONS

We have options and relationships available that cater to the needs of both first-time home buyers and seasoned investors.

PRESIDIO PROVIDES SOLUTIONS

PRESIDIO BUYING SYSTEM

Our strategic approach uses critical data and technology to review the physical and financial wellness of each home to protect and enhance the buyer experience and investment.

We empower clients by connecting them to the right lenders, insurers, appraisers, inspectors, and financial advisors.

Our aim is to help navigate and protect the most important purchase you will ever make.

We empower clients by connecting them to the right lenders, insurers, appraisers, inspectors, and financial advisors.

Our aim is to help navigate and protect the most important purchase you will ever make.

1

PREPARE BUYER

Evaluate Financial Readiness Of Buyer

Determine Goals/Objectives Of Clients

Share Current Market Conditions

Set Expectations (The Reality Check)

Identify Funds Needed To Qualify

Start Pre Approval Process

Complete The Preapproval Process

Determine Goals/Objectives Of Clients

Share Current Market Conditions

Set Expectations (The Reality Check)

Identify Funds Needed To Qualify

Start Pre Approval Process

Complete The Preapproval Process

2

START SEARCH

Search Based On Client Criteria And Evaluate Homes Based On Values

1.Location

2.$ Square Foot

3.Added Amenities

4.Evaluate Condition & Repairs

5.Walking Score

6.Appreciation History & Potential

7.Review Daily Listings

8.Tour Approved Homes

1.Location

2.$ Square Foot

3.Added Amenities

4.Evaluate Condition & Repairs

5.Walking Score

6.Appreciation History & Potential

7.Review Daily Listings

8.Tour Approved Homes

3

PROPERLY IDENTIFY

The Right Home For Them

Determine Offer Strategy

Ensure Financing Is Secured

Determine Offer Strategy

Ensure Financing Is Secured

4

SUBMIT OFFER

Negotiate Effective Offer

Prepare Contract

Get Bank Draft Ready

Identify Escrow Partner

Receive Acceptance

'Condition' Waivers Signed

Prepare Contract

Get Bank Draft Ready

Identify Escrow Partner

Receive Acceptance

'Condition' Waivers Signed

5

INSPECT AND EXPLORE

Complete Standard Inspections

1.Home

2.Neighborhood

3.Schools

4.Taxes

5.Review Hoa Docs

6.Evaluate Homeowner Insurance

7.Complete Home Appraisal

1.Home

2.Neighborhood

3.Schools

4.Taxes

5.Review Hoa Docs

6.Evaluate Homeowner Insurance

7.Complete Home Appraisal

6

REPAIR AND IMPROVEMENT

Review Inspection

Review Appraisal

Ensure Home Value

Discuss Repair Strategy

Request Improvement

1.Complete Final Walkthrough

2.Ensure Clear To Close

3.Final Deposit

4.Finalize Documents

5.Documents To Escrow

Review Appraisal

Ensure Home Value

Discuss Repair Strategy

Request Improvement

1.Complete Final Walkthrough

2.Ensure Clear To Close

3.Final Deposit

4.Finalize Documents

5.Documents To Escrow

7

COMPLETE REVIEW

Legal Review Documents

Hud Finalize Settlement Statement

Procure Title Insurance

Hud Finalize Settlement Statement

Procure Title Insurance

8

CLOSE AND RECORD

Final Review And Signatures

Legally Record The Transaction

Legally Record The Transaction

FEATURED LISTINGS